Tax Documents Checklist

- States Where the IRS Has Extended the Tax Deadline

- Health Savings Plan Distributions & 1099-SA

- Did you receive a state or local refund last year?

- Do I need to report my Social Security benefits?

- Who can take the Retirement Savings Contributions Credit? (Savers Credit)

- How to Report Gambling Winnings with a Form W-2G

- How Do I Claim Refundable Credits After Disallowance?

- What is an IRS Issued Identity Theft PIN (IP PIN)?

- Who Can Take the Credit for the Elderly or Disabled (Schedule R)?

- Did you collect unemployment compensation from a state or local government assistance program?

- What is the Recovery Rebate Credit?

- How to file for a federal or state income tax extension

- Taxpayer COVID-19 FAQ

- The New Simplified 1040 Tax Form

- Are my alimony payments considered earned or taxable income?

- Using an AGI, Self-Select or IP PIN to verify a taxpayer’s ID

- Do I pay taxes on my unemployment benefits from when I was out of work?

- At what point should my dependent file his/her own tax return?

- What is the marriage penalty?

- If a taxpayer works overseas, do they pay federal taxes on the income? What forms need to be completed?

- Bitcoin and tax liability

- Are all state filing laws the same as federal laws? How do I find out the laws in my state?

- What are capital assets, gains and losses? How do I figure them out?

- Is it still possible to get a tax deduction for charitable giving after the latest tax reform?

- Are my tips considered earned or taxable income? What if I forget to report some of them?

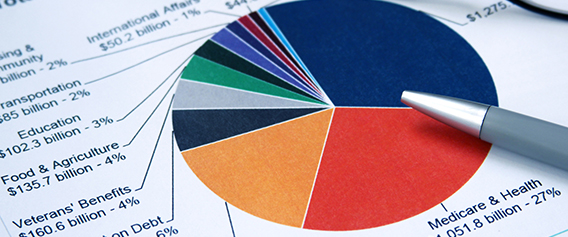

What Your Taxes Actually Pay For

Probably every taxpayer, at some point or another, has found themselves wondering: What do my taxes actually pay for? According to the Center for Policy and Budget Priorities, in fiscal year 2016, the federal government spent $3.9 trillion, $3.3 trillion of which was financed by American taxpayers.

... Read More

From Tummy Time To Tax Time: The New Parents’ Guide To Filing

So much changes when you become a parent. You stop worrying about missing that trendy pop-up dinner, and start worrying about feedings and sleep schedules. Your idea of entertainment changes from an exciting night out with friends, to a relaxing evening of Netflix and a (hopefully) sleeping baby.

... Read More

What If Dogs Filed Taxes

We understand filing taxes may not be much fun, so we thought we’d have a little fun with a somewhat silly post on if dogs had to file a tax return.

... Read More

Oops, I just realized I forgot something on my tax return (What do I do now?)

What if after filing and going through your mental checklist you realize that, oops — you forgot to file something. What do you do now? Well the IRS has a form for that. It’s called the 1040X. There are many different reasons why it might be necessary to file an amended return such as a change in your income, deductions or credits.

... Read More

From Headache to Cakewalk

It’s the time of year when tax filing is on most people’s minds. Maybe you’re relieved to have filed early and to have already put your refund to good use. Maybe you’re currently up to your eyeballs in tax forms, hoping for the best. Or maybe you’re imagining all the cool things you could do with some extra cash as you eagerly await your refund.

... Read More

Strange State Tax Laws You Won’t Believe

When you’re filing your federal taxes, plenty of the rules and requirements can leave you scratching your head. You can write off this, but not that. You can claim this credit, but only in this particular circumstance. It’s enough to get anyone confused.

... Read More

Reactions To IRS Tax Refund Status Updates: A Stream-of-Consciousness Diary

We frequently receive questions from users about the IRS’s Where’s My Refund? tool. This tool, which offers status updates on a taxpayer’s refund, can be extremely helpful but it can also lead to some unneeded anxiety when used too frequently. The tool says it’s only updated once a day and each time it changes may be cause for celebration, because you’re one step closer to your refund. However, following it too closely can add undue stress as demonstrated in the following hypothetical journey of a tax filer… Tuesday Yes!! I finally finished my taxes. Thank goodness – that’s been weighing

... Read More

The Ultimate Procrastination: Filing Taxes Late

Why do we procrastinate when it comes to tackling our tax returns? Before you file your taxes late, make sure you file a request for extension. Although it may require you to estimate and pay your taxes, filing an extension will allow you until October to finalize and file your tax return. The advantage to doing this, is it will help you to avoid the large penalties for failing to file your return.

... Read More

Asking For an Audit: The 4 Biggest Tax Filing Mistakes To Avoid

You know the deal: unless you’re making some serious cash, it’s highly unlikely that the IRS will audit you. For Millennials, the likelihood of a tax audit is pretty close to zero. That is, unless you end up with a suspicious-looking tax return. But how do you know if your tax return looks suspicious? Well, if you’re trying to game the system, which, by the way, is a huge no-no, then chances are your tax return will have some red flags that spur the IRS to investigate.

... Read More

What to Know About Federal vs. State Taxes

If you’re still a novice when it comes to filing your taxes, you may be pretty intimidated by the idea of filing two separate returns – federal and state. It sounds like double the work, right? Thankfully, that’s not entirely the case. Filing state taxes after you’ve filed your federal taxes doesn’t have to be difficult if you use a tax preparation software service like E-File.com. So what makes your state taxes different from your federal taxes? Here’s what you need to know. Federal income tax applies to everyone Federal income tax law is imposed by the federal government. As

... Read More